162 An Experiment: Build Ray Dalio's All Weather Portfolio using Malaysia Unit Trust 一个实验:用马来西亚信托基金尝试重建达里欧全天候资产组合

Who is Ray Dalio?

Raymond Thomas Dalio is an American billionaire investor and hedge fund manager, who has served as co-chief investment officer of the world's largest hedge fund, Bridgewater Associates, since 1985. (Source: Wikipedia)

What makes Ray Dalio to create All-weather Portfolio?

The principles behind All Weather relate to answering a deceptively straightforward question explored by Ray with co-Chief Investment Officer Bob Prince and other early colleagues at Bridgewater — what kind of investment portfolio would you hold that would perform well across all environments, be it a devaluation or something completely different? (Source:- The All Weather Story)

What is the breakdown of All Weather Portfolio?

Weight Investment Themes

30.00 % U.S., Large Cap

40.00 % Bonds, U.S., Long-Term

15.00 % Bonds, U.S., Intermediate-Term

7.50 % Gold

7.50 % Commodity, Broad Diversified

Breakdown the All Weather Portfolio using Malaysia Unit Trust

In fact, if investors have stock trading account that can trade US stocks, he can actually build the portfolio using US' ETF (like VTI etc).

But let say I am more comfortable with local unit trust, can I duplicate a similar portfolio. Let's try to see each category. I will use info from FundSuperMart Malaysia and Morningstar Malaysia.

U.S., Large Cap

In Malaysia, there are two US Equity funds available to retail investors.

- Manulife Investment U.S. Equity Fund - MYR Class

- RHB-GS US Equity Fund

Bonds, U.S., Long-Term and Bonds, U.S., Intermediate-Term

For local unit trust, there is no retail unit trusts invested in US bonds. So, let's replace with local unit trusts. Below is the one I always use.

- Amanahraya Unit Trust Fund

- Amanahraya Shariah Trust Fund

Gold

There are altogether four funds in this category, but only the below two are more than 10 years old.

- RHB Gold And General Fund

- Precious Metals Securities

Commodity, Broad Diversified

For commodities, we search using the word "resources".

- Manulife Global Resources Fund

- RHB Resources Fund

I am going to pick one or two funds from each category. (Warning: This selection is based my personal preference. It is not objective. Please do not follow!)

U.S., Large Cap:- Manulife Investment U.S. Equity Fund - MYR Class

Bonds, U.S., Long-Term and Bonds, U.S., Intermediate-Term:- Amanahraya Unit Trust Fund, Amanahraya Shariah Trust Fund

Gold:- RHB Gold And General Fund

Commodity, Broad Diversified:- Manulife Global Resources Fund

The Returns of Individual Funds

The total returns and annualised returns of each funds are as below chart. I use Chart Center from FundSuperMart Malaysia.

Apparently, if I simply invest in Manulife Investment U.S. Equity Fund - MYR Class, my annual returns for the past 10 years is 14.39%. This is consider very good especially when we consider the recent drop of roughly 25%. However, the volatility — at 22.42% — is very high too.

If I am very kiasi, and were to fully invest in bonds — namely Amanahraya Unit Trust Fund and / or Amanahraya Shariah Trust Fund — my returns 2.79% & 1.94% only. Actually the returns were dragged down because of the effect of US rising interest rate.

How about combined them into a portfolio? The All Weather Portfolio!

For this, I use Portfolio Simulator from FundSuperMart Malaysia. The assumptions are

- Initial Investments:- RM100,000

- Backtest Period: - 10-Yr

- Rebalancing:- Quarterly

- Wholesale Funds:- No

Portfolio 1:-

- 100% Manulife Investment U.S. Equity Fund - MYR Class

Portfolio 2:-

- 30% Manulife Investment U.S. Equity Fund - MYR Class

- 30% Amanahraya Shariah Trust Fund

- 25% Amanahraya Unit Trust Fund

- 7.5% RHB Gold And General Fund

- 7.5% Manulife Global Resources Fund

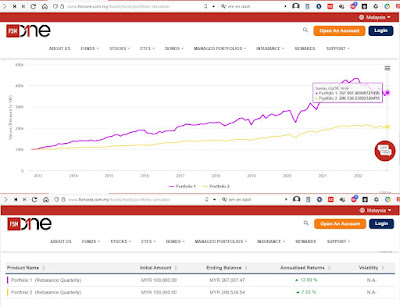

The results are

The annualised returns for Portfolio 1 is 13.89% (RM100,000 becomes RM367,007). The annualised returns for Portfolio 2 is 7.52% (RM100,000 becomes 206,538).

Portfolio 2 is significantly lower than Portfolio 1, but the chart is much smoother too. Considering the current market situation (equity and bonds tanked together), I think Portfolio 2's returns is very good and not so stressing.

The largest drawdown during the current market crash

From experience, investors always think they are aggressive investors who can tahan market crash, but in fact they are not. See -5%, still can tahan. See -10%, a little bit uneasy. See -15%, maybe cannot tahan liao. See -20%, sell sell sell.

So, let's see how much was the largest drawdown during the current market crash.

Comparatively, I think losing -6% is less stressful than losing -21%.

计算如下:-

Small Conclusion

I think this Ray Dalio All Weather Portfolio is very suitable for investors who are seeking higher returns with fairly lower volatility. Most important of all, the portfolio can absorbs unexpected shocks like stock market crash. In the normal situation, bonds will rise when stock market go lower. Likewise, gold and commodities — which has inverse relationship with equity — will also help to lift the portfolio value.

Reminder:- I do not currently own such All Weather Portfolio.

////////// SEPARATOR 分割线 /////////

请问谁是达里欧先生啊?

雷蒙德·托马斯·达利奥(英語:Raymond Thomas Dalio,1949年8月8日)出生于纽约,现居康乃狄克州费尔菲尔德县,是美国对冲基金经理、慈善家。雷·达利奥是桥水基金公司的创始人兼首席執行官,而橋水基金於2013年被列為全世界最大的避險基金公司。(来源:维基百科)

达里欧先生为何要找寻这个全天候投资组合啊?

全天候投资组合背后的原则其实就是为了回答这些人的一个非常简单明了的问题。这些人是达里欧、co-Chief Investment Officer Bob Prince、以及桥水基金早期同事们。这个问题就是 — 怎样的组合才是你想要持有的组合,即任何环境下(货币贬值也好、其他情况也好)都有好的表现的组合? (自己翻译。有错请指教。Source:- The All Weather Story)

全天候投资组合由什么合成啊?

比重 投资主题

30.00 % 美国大型股

40.00 % 美国长期债券

15.00 % 美国短期债券

7.50 % 黄金

7.50 % 一般大宗商品

试试看用本地信托基金合成这个全天候投资组合咧

其实捏,如果投资者有股票投资户头,他们就可以直接买入美国 ETF 来配置这样的全天候投资组合滴。

但是,万一我比较喜欢本地信托基金,可不可以配置接近接近的组合呢?我们一样一样来看。我会用 FundSuperMart Malaysia 和 Morningstar Malaysia 的网站来找资料。

美国大型股

在本地,只有两个美国基金是开放给所有投资者的。

- Manulife Investment U.S. Equity Fund - MYR Class

- RHB-GS US Equity Fund

美国长期债券、美国短期债券

本地信托基金,没有专门投资美国债券的。所以我用本地基金来代替。以下是我常用的。

- Amanahraya Unit Trust Fund

- Amanahraya Shariah Trust Fund

黄金

这个组别里面有四个基金,但是只有两个基金有十年历史。

- RHB Gold And General Fund

- Precious Metals Securities

一般大宗商品

大宗商品,我们用关键字 "resources"。

- Manulife Global Resources Fund

- RHB Resources Fund

现在啊,我从每个组别选一两个基金。 (提醒!以下所选的全部是根据我的喜好,并不是客观的分析。请不要贸贸然跟喔!盈亏自负!)

美国大型股:- Manulife Investment U.S. Equity Fund - MYR Class

美国长期债券,美国短期债券:- Amanahraya Unit Trust Fund, Amanahraya Shariah Trust Fund

黄金:- RHB Gold And General Fund

一般大宗商品:- Manulife Global Resources Fund

各个基金的回酬

各个基金的回酬如下图所示。我用 FundSuperMart Malaysia 的 Chart Center 。

很明显的,如果我单押 Manulife Investment U.S. Equity Fund - MYR Class ,我的10年复利回酬是 14.39%。以现在的环境,美股跌了大概25%,还有这样的回酬算是非常了不起的。可是啊,波动率 — 22.42% — 也是很高捏。

假设我是怕死的投资者,全部单押债券的话 — Amanahraya Unit Trust Fund 或者 Amanahraya Shariah Trust Fund — 我的回酬只有区区 2.79% & 1.94% 罢了。这样的回酬其实是被美国升息的影响拉低的。

啊,如果把他们做成组合会怎样?全天候投资组合喔!

现在就要用到 FundSuperMart Malaysia 的 Portfolio Simulator 。所做的假设如下:-

- 初始投资额 Initial Investments:- RM100,000

- 回测期限 Backtest Period: - 10-Yr

- 再平衡 Rebalancing:- Quarterly 每季

- Wholesale Funds:- No

组合 1:-

- 100% Manulife Investment U.S. Equity Fund - MYR Class

组合 2:-

- 30% Manulife Investment U.S. Equity Fund - MYR Class

- 30% Amanahraya Shariah Trust Fund

- 25% Amanahraya Unit Trust Fund

- 7.5% RHB Gold And General Fund

- 7.5% Manulife Global Resources Fund

成绩来咯

组合1的复利回酬为 13.89% (RM100,000 滚成 RM367,007). 组合2的复利回酬为 7.52% (RM100,000 滚成 206,538).

组合2的回酬明显低于组合,但整条线图明显平顺很多,代表着波动比较低。依目前的市场来说组合2的回酬亮眼又比较没有压力。

本波股市下跌最大跌幅

倚老卖老,投资者总是高估自己是激进型投资者,即可以忍受市场暴跌,事实却又很残忍。当他们看到 -5%,还可以顶。看到 -10%,有一点紧张了。看到 -15%,应该顶不顺了。看到 -20%,快点卖,天要塌了。

那就让我们来看看此次股市下跌的跌幅。

小总结

个人认为达里欧的这个全天候投资组合非常适合那些要稍高回酬、稍低风险的投资者,比如退休人士。尤为重要的,此组合能承受股市暴跌的震荡。在正常的情况下,股市下跌、债券会上。黄金以及一般大宗商品也能提振组合的价值,因为这两种与股市也是呈相反的联动。

再次提醒。本人目前没有全天候投资组合!