159 Private Managed Accounts (PMA) - your answer to local shares investment 本地股票投资

A lot of investors may be interested in investing in shares, but without the knowledge or time to do so. The current work around method is investing in unit trust to indirectly investing in shares. Now, investors can consider using PMA to hold shares.

What is PMA?

PMA is very similar to unit trust or fund of funds, depending on the target investment. The major difference between unit trust and PMA is management of investors' money.

In unit trust, all investors' money are put into a pool or a unit trust fund and then managed by a fund manager. During redemption time, investor will get back his investment in money only.

While in PMA, fund manager managed an investor's money separately from other people's money. During redemption time, investor has the choice of getting back his investment in money or shares etc.

Simple analogy to understand PMA

Let's say today I found a very good business that is worth investing, but I do not know how to run the business, I can invest in the business and become a sleeping partner. All I need to do is periodically spot check on the business or the account. At one day if I want to withdraw from the business, I get back my share in money. This is unit trust.

Let's say today I found a very good business that is worth investing, but I do not how to run the business, instead of joining the business as a sleeping partner, I decided to come out with the capital and employ a capable manager to run it for me. All I need to do is periodically spot check on the business or the account. At the same time, I may or may not want learn how to run the business. At one day, if I decided to terminate the manager's contract, (1) I can decide whether to sell the business and pocket the money, or (2) I can take over the business and run it myself. This is PMA.

Why PMA?

From the simple analogy, you can get the idea PMA is building an investment portfolio for your future. Why do I say so? Because we have many PMA mandate that may be beneficial to investors.

Examples:-

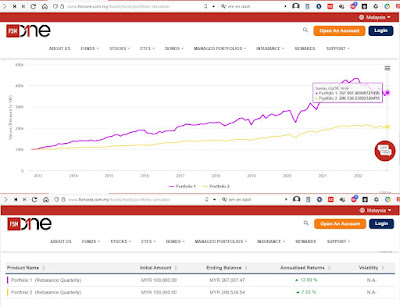

PMA Blue Chips - In this portfolio, Phillip's fund manager will invest investor's money into blue chips stocks.

PMA Dividend Enhanced - In this portfolio, Phillip's fund manager will help investors to invest in dividend stocks.

PMA Opportunity - In this portfolio, Phillip's fund manager will help investors to in small- and mid-cap stocks.

PMA UT - For investors who are not comfortable investing in stocks, PMA UT invest in a portfolio of unit trust funds that fund manager identified to be the best in the category.

So, imagine you are still working and you build your blue chips stocks or dividend stocks. By the time you retire, you can transfer all the shares into your personal CDS account and start getting those dividends.

PMA suitable for you?

I like to encourage investors to have a retirement fund making up of diversified portfolio. You must have EPF, PRS, unit trust and shares.

For shares, investors may not have the knowledge or time to invest. Why not give it to professional fund managers? Investors can top up regularly and build up a portfolio of shares for retirement.

I especially encourage investors to have blue chip stocks and dividend stocks. During retirement, we want passive income - dividend from EPF, unit trust, and shares.

Why not build it now instead of waiting until retirement? Working years are the prime investing time because we have regular income, sufficient time for portfolio to grow and top up to make grow bigger.

After retirement, we may have become too conservative to invest!

* * * * * * * * *

159 Private Managed Accounts (PMA) 本地股票投资的方案

有许多投资者有兴趣投资股票但却没有相关能力1或时间。目前只能透过信托基金来间接投资股票。投资者不妨考虑透过 PMA 持有股票。

什么是 PMA?

PMA 是辉立独有的投资产品,它类似信托基金或是 fund of funds,这就取决于投资在哪里。PMA与信托基金最大的差别在于投资者的钱如何管理。

在信托基金里,所以投资者的钱都会放进同一个基金里,然后由基金经理管理。在赎回时,投资者只以钱的方式拿回投资。

而在 PMA 呢,基金经理单单管理某位投资者的钱,不能把这位投资者的钱跟别的投资者的钱参在一起管理。在赎回时,投资者可以选择拿钱或是拿股票。

理解 PMA 的简单比喻

假设今天我发现了某个有利可图的生意,但我又不会管理,我可以参股成为睡觉的股东。我就是不时不时的查看生意或是账目。到某一天我决定退股啦,我只能以金钱的方式拿回我的那一份。这就是信托基金啦。

又假设我发现了某个有利可图的生意,但我不会管理,我可以出资然后请有本事的经理来管理。我就不时不时的查看生意或是账目,甚至从中学习。知道有一天时机成熟了,哦我决定不需要那位经理来管理了,我可以卖掉整盘生意或是自己接着做。当然也表示将来我可以让孩子继承生意喔。这就是PMA啦。

为何选 PMA?

从以上的比喻,你应该可以理解可以通过 PMA 来建立未来的股票投资组合。怎说呢?PMA 里有几个组合挺好的。

例如:-

PMA Blue Chips - 辉立的基金经理会把投资者的钱投资在蓝筹股。

PMA Dividend Enhanced - 辉立的基金经理会把投资者的钱投资在有派股息的股票里面。

PMA Opportunity - 辉立的基金经理会把投资者的钱投资在中、小型股票里。

PMA UT - 对于还不能接受股票的投资者,基金经理会把投资者的钱投资在有潜能又是最好的信托基金里面。

所以呢,试想你还在工作却已经开始建造你的蓝筹股或是股息股,以便你退休时,你可以把这些好股票转入你私人的 CDS 来收股息。多好呢?

PMA 适合你吗?

我乐意鼓励投资者把自己的退休金建造成多方收入的组合。你一定要有公积金、私人退休金、信托基金以及股票。

股票呢,不是每个人有能力或时间投资的。即如此,何不交给专业的基金经理呢?投资者可以不时的加码来创造更多股票组合供退休用。

我尤其鼓励投资者拥有蓝筹股和股息股。此类股票一般都属于大型的、赚钱的公司,所以比较安稳点。退休时,我们就像可以收到被动收入嘛 - 来自公积金、信托基金和股票的股息嘛。

因此,与其等到退休后,何不现在开始呢?乘着还在工作时仍然有固定收入、又有足够时间让投资增值变大时,开始吧。

退休后,可能我们已经变得保守而不敢投资了呢!