167 Endowment Plan of a friend (cont.) 朋友的储蓄保单(续)

My last post talked about my friend's endowment policy, where I asked him to find out how many they waited before maturity value paid out.

He managed to find the policy, snap shot a few pages to me. I calculated the rate of return, replied him, but he is a bit sad.

So the premium paying period for the endowment policy is 20 years. At the end of 20 years, there will be a maturity value. In the first 20 years, annual premium was RM1332, maturity value is RM34019。

Internal rate of return is 2.27%, as shown below.

Reverse calculate to check whether 2.27% counted by spreadsheet is correct or wrong. (Exact interest rate should be 2.2717%)

My friend is sad because the internal rate of return is even lower than FD rate. Past 25 years FD rate in Malaysia are as below. (Individual banks may have launched better rates, but I don't have any data.)

If the premium had been put in FD, how much will the difference be? (Individual banks may have launched better rates, but since I don't have any data, I rely on data in above table.)

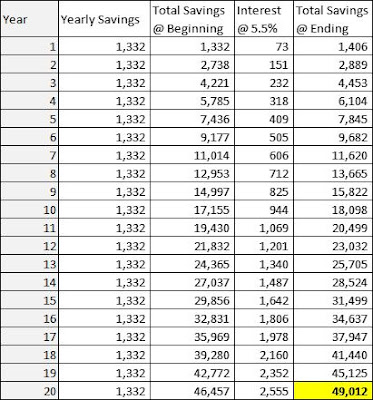

On hindsight, my friend thinks he might as well put the money in bond fund to make more money. He said if bond funds can returned 5.5% per annum, it will be RM49012 after 20 years. Then it will be a difference of RM15000.

- Insurance or savings or investment are different products. If that product is deemed to be suitable for buyer during buying time, it is the the best product. No point regretting later.

- Since insurance or savings or investment are different products, they should be complementing each other, not competing. If something bad happened, insurance came to rescue. When nothing happened, investment plays its role.

- When the investment horizon can be as long as 20, 30 years, too small an investment amount won't create jaw dropping total sum. In the early stage, the investment amount can be small, but as salary increase, so must the investment value. Just think of our EPF, who didn't start with twenty thirty fifty bucks, then proceed to a hundred, two hundred, three hundred and so on until it become a huge amount because of compounding interest.

- When the investment horizon can be as long as 20, 30 years, investing in a too conservative tool is a waste of time. At the very least, one can create a portfolio of high and low risk products, to increase the rate of return. We can see the difference of 3% and 5.5% from the above discussion.

* * * * * SEPARATOR 分割线 * * * * *

上一篇说到朋友的储蓄保单,就是要他去问清楚还完供期后等了多少年才拿到最终价值。

他把保单给找了出来,拍了几张照片给我看。把回酬率算了一算,告诉了他,不想朋友有点儿伤心了。

原来该储蓄保单总共要还20年,第20年到期后可以拿到最终价值。头20年,每年的保费是RM1332。最终拿到的最终价值为RM34019。

回酬率2.27%,如下。

反向试算2.27%利率对或错。(切确是2.2717%)。

朋友伤心是因为回酬率少过定期存款利率。马来西亚过去25年的定期存款利率如下图。(个别银行可能曾推出更加优惠的利率,我没有资料。)

那如果那些年的那些钱放在定期存款,结果差别多少呢?(个别银行可能曾推出更加优惠的利率,我没有资料,就只能用以上的资料试算。)

朋友觉得要是早知道,倒不如就投资于债券型基金,可以拿到更高的总额。他说如果债券型基金有5.5%的回酬率,那20年就有RM49012。如此就有RM15000的差别了。

- 保险、储蓄、投资是不同的产品。在那个时候某个产品适合买者的需要,那个产品就是当下最适合的产品。事后不要再懊悔了。

- 保险、储蓄、投资既然是不同的产品。应该成为互补,而非有我没他。万一发生什么事时,保险发挥功能。而如果没事发生,投资发挥功能。

- 当投资年限可以跨度20、30年,太小的投资金额就创造不出称羡的总额。因此,初期金额可以小,但随着薪水的增加,宜适度增加投资金额以期创造更大的总数。就想我们的公积金啊,谁不是刚开始时几十块钱几十块钱,然后慢慢变一百、两百、三百,又利滚利的越来越多。

- 当投资年限可以跨度20、30年,仅投资太过保守的投资标的,太可惜了。至少至少也应该有一个高低风险搭配的组合,适度提高投资报酬率。以上可以看到3%跟5.5%的差别。

No comments:

Post a Comment